Among the myths writers often entertain is Never-Always. You may have it embroidered on the fabric of your mind regarding your writing projects or career:

Yes means forever.

Be encouraged today. Those are myths, as are other …

The Agents of Books & Such Literary Management Muse About Books, Publishing, and Life

// by Cynthia Ruchti// 11 Comments

Among the myths writers often entertain is Never-Always. You may have it embroidered on the fabric of your mind regarding your writing projects or career:

Yes means forever.

Be encouraged today. Those are myths, as are other …

// by Wendy Lawton// 5 Comments

Just this week I was copied on an email from one of my clients, Jill Eileen Smith, to her publicity manager at her publishing house. They were talking about a stellar review she received on her newest book, The Ark …

// by Janet Grant// 10 Comments

Is a book club (or more than one) a part of your life? If not, you’re missing out on being part of the resurgence in book clubs. As writers, we embrace the idea of others coming together to discuss books …

// by Debbie Alsdorf// 7 Comments

Twenty five years ago I signed my first official publishing contract. I knew very little about publishing and even less about what to expect personally. I was in my early forties, a ministry leader in a large mega-church when contacted …

// by Rachel Kent// 6 Comments

I came across an article in The Huffington Post about classic books and their original titles. Most of them are SO different from the true title of the work.

Here is a brief list, but be sure to check out …

// by Barb Roose// 3 Comments

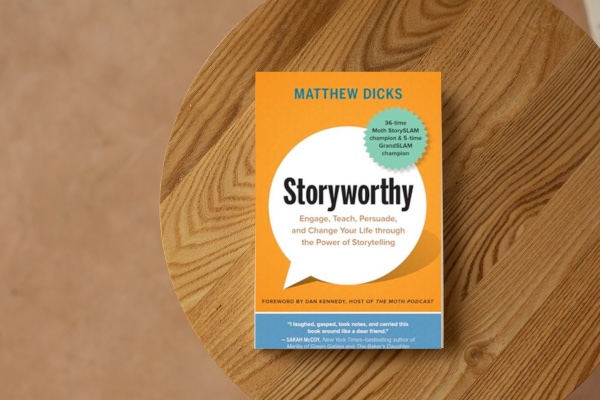

The universe is made of stories, not of atoms.

Muriel Rukeyser

One of a writer’s great fears is running out of words or fresh stories to tell. Our creative souls relish the adventure of unexpected twists and discoveries and translate …

Homework for Life: Never Fear Running Out of Stories Again!Read More

// by Cynthia Ruchti// 13 Comments

What’s with all the talk about websites for writers? How important are they, especially if the writer isn’t published yet? How do you best work your writer website?

One of the first things an editor or agent will do when …

// by Wendy Lawton// 3 Comments

Wanna see a writer stand frozen with that deer-in-the-headlights look? Just ask them this question: “So. . . what’s your novel about?”

Here’s a list of the WRONG things to answer:

// by Janet Grant// 10 Comments

Last week Parable Group, which is a consortium of independently-owned Christian bookstores throughout the United States, released their report, “2024 State of Christian Retail.” As I studied the results of their survey of booksellers, I saw lots of bookstore …

// by Janet Grant// 5 Comments

This blog spot is usually reserved for instruction or encouragement, and it is today as well. We’re sharing some great Books & Such author news to help encourage you to keep pressing on. Some of these authors waited a long …